Non-Compliant Materials

Insurance implications

There has been a large amount of media coverage around compliance and regulation of the Australian construction industry in the last month, damaging its reputation and confidence. SHC are taking a leading role in advising their clients of the risks and solutions available for this evolving liability.

Construction related Insurance Risks fall into 4 categories:

- Physical risks – Insured through property policies including Contract Works.

- Third Party Legal and statutory implications – Covered through Legal Liability / Products Liability and Management Liability policies

- Errors and Omission in design, plans and specifications / Advice – Covered through Professional Indemnity policies

- Defective Work – This has only recently become available outside Statutory policies (Home Warranty) and is now available through our Latent Defects policy.

The result of changing market conditions globally, as well as the local challenges, has effected the availability of Professional Indemnity capacity within the Construction industry. One particular issue surrounds non-compliant products previously installed. Professional Indemnity, unlike most policies, covers the claim event when it occurs, not when the structure was built (claims made is the Insurance term used). This means if a condition or exclusion is placed on a policy in the 2019 year, it has the potential to apply retrospectively. This is a major concern when evolving or latent issues arise. We are now seeing endorsements applied to all Professional Indemnity policies similar in nature to the following that relies of the various standards and regulations existing within the Industry (this example relates to Cladding specifically).

CLADDING EXCLUSION

Underwriters will not indemnify the Insured for any Claim arising directly or indirectly or in connection with any advice, design, material specification, material selection, fabrication, installation, application, erection, construction, use, approval or certification of or relating to any Cladding System:

- that is not compliant or does not conform; or

- that is installed, applied or used in a manner that does not comply, with all relevant provisions of:

a) the National Construction Code of Australia;

b) the Building Code of Australia;

c) Australian Standards;

d) approved conditions of use or application;

e) any other applicable law or regulation.

SHC insurance brokers have been proactively involved in working with key stakeholders in relation to new products including Latent Defects Insurance to try to overcome these challenges moving forward. To find out more about your options and a review of your current insurance portfolio, including Professional Indemnity Insurance and Latent Defects solutions, drop Brett an email (click here) or call on 1300 550 665.

For further information review the articles below.

Related articles

The insurance Council of Australia has issued a media statement and requests the government to act – such as, “Current risk-management regimes in construction are clearly failing to prevent avoidable and significant losses. Partial and piecemeal fixes by governments are not going to restore public and insurer confidence in the construction sector.” (full article)

Along with this call for national legislation & regulation, the Insurance Council highlight the fact that insurance companies' Professional Indemnity Insurance products WILL NOT COVER non-compliant materials.

This is backed up by a media release from Insulation Australia, with its Chairman, Scott Gibson warning, “the Australian building and construction industry, that work involving non-conforming materials will no longer be covered by most PII policies”. (full article)

Home Warranty Changes

Effected August 1, 2019

There have been further changes to your Home Warranty premiums highlighted by the Government last week in their most recent announcement.

After lobbying by SHC and others, HBCF have agreed to review their pricing in relation to duplexes, triplexes, Granny flats and Terraces known as C09.

An excellent outcome was achieved resulting in premiums being repositioned to single dwelling, C01 pricing effective 1/8/2019.

Other information provided in the Q&A document is available on the HBCF website, refer following link.

Icare Home Warranty Premium Rates

Main points

- Premiums are being adjusted to reflect the latest assessment of breakeven premium rates for all construction types.

- The premium changes scheduled for 1 August aim to make the fund sustainable (or break-even position), consistent with the previously announced objectives of the Government’s reforms.

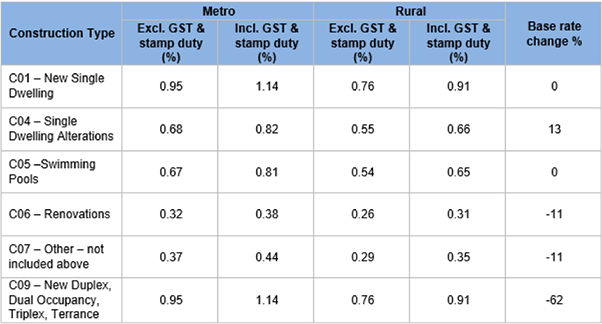

- The changes vary depending on construction type. The below table sets out the changes, if any, for each type except for multi – dwellings which will be shown in a different table.

- Multi-Units will be increased based on becoming break-even and will incur considerable premium increases held back from the October 2018 price review, please make sure you contact our office before costing these projects effective immediately.

- In line with the premium increases, and the elimination of commission for the Broker, SHC will slightly adjust their fee for service to align with the Government increases and decreases that ensures that SHC continues to offer the highest quality service in managing your Home Warranty insurances whilst staying competitive in the market

Base Premium % numbers

(Note Government charges and fees to be added).

Base premium rates by construction type - Non-Multi dwelling construction

Multi-Unit premiums will increase in 4 tranches;

Base premium rates by construction type - Multi dwelling construction

* Note rates in this table are for Metro area, a 20% discount applied to rural area.

> Tranche I – 1 August 2019

> Tranche II – 1 January 2020

> Tranche III – 1 July 2020

> Tranche IV – 1 January 2021

Contact SHC Insurance Brokers today to help you get set up with our simple process that saves you money

Call 1300 550 665

Latent Defects Insurance

- 1st for Australia – SHC has sourced this special product on behalf of its clients and the Australian construction industry.

- Transfer Defects risk and rectification costs off your balance sheet to the insurance company.

- Builder held harmless – cannot be held responsible and pay (no liability).

- Commercial or Domestic (any size).

- Cover for; Builders, Developers, Owners and Strata Body Corporates.

- Cost Effective Insurance.

- No personal guarantees.

- Simple Application and Process.

- Cover up to $10m per project (more on application).

- Cover up to 10 years.

- Great Security – Lloyd's of London.

Have questions about Latent Defects Insurance,

click here to go to our website FAQs or click button below to download pdf

This insurance product is the first in Australia that can cover the risk of costs associated with rectification for Latent Defects. Currently the Builder and Developer bear the entire risk and cost should something go wrong which can have serious repercussions and adverse effects on their Balance Sheet, profitability and financial position. This product allows the transfer of that financial risk onto the insurer for the amount of the Sum Insured.

For Commercial Construction (including all High Rise) the need for Latent Defects Insurance is obvious (e.g. Opal and Mascot Towers). For Domestic Construction the need for this insurance also continues to be obvious to any builder who has previously borne the cost of rectification works. Statistics show that 1 in 8 houses require rectification at an average cost of 4% of the total contract value – all currently paid by the builder.

Want Latent Defects Insurance?

Don’t be caught out ever again without purchasing this insurance from SHC Insurance Brokers – please use the Link below to register your interest in Latent Defects Insurance or call Brett Graves (Director) or Richard Durnell (Executive) on 1300 550 665.

Why use SHC as your brokers?

SHC continually exhibits dedication to our clients claims management.

A recent storm event caused a commercial dwelling's roof to collapse due to water pooling, causing tens of thousands of dollars of damage to the property.

The business involved did not have the ability to trade at that location coupled with the Insurer initially declined the claim stating the roof was not in reasonable condition and suffered too much from wear and tear.

SHC representing the client, were able to argue with the insurer that it was not reasonable for our client to climb on their roof regularly to inspect the condition of the roof, noting there was no prior evidence of water damage.

The claim was granted in good time and our client had minimal delays in reinstating their building and business trading.

Let SHC Insurance Brokers review your insurance needs today and support your business in future, should a crisis occur!