SHC would like to offer all our clients special discounts on transferring their general insurance portfolios over to SHC, including Contract Works, if they haven’t already done so.

We can either quote against the existing policies and save money, or refund money directly back to the client simply by appointing SHC as your Broker of choice (a simple signature).

Therefore, if you don’t already have your general insurances with SHC, take advantage of this limited offer, by calling Renee, Richard or Brett.

As always and where possible, we are happy to come to you and discuss what is possible.

Why use SHC as your brokers

SHC continually exhibits dedication to our clients claims management.

A recent storm event caused a commercial dwelling a roof collapsed due to water pooling, causing tens of thousands of dollars of damage to the property.

The business involved did not have the ability to trade at that location coupled with the Insurer initially declined the claim stating the roof was not in reasonable condition and suffered too much from wear and tear.

SHC representing the client, were able to argue with the insurer that it was not reasonable for our client to climb on their roof regularly to inspect the condition of the roof, noting there was no prior evidence of water damage.

The claim was granted in good time and our client had minimal delays in reinstating their building and business trading.

Home Warranty Changes

Effected August 1, 2019

There have been further changes to your Home Warranty premiums highlighted by the Government last week in their most recent announcement.

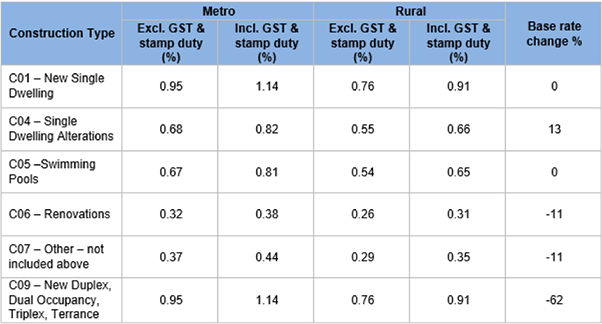

After lobbying by SHC and others, HBCF have agreed to review their pricing in relation to duplexes, triplexes, Granny flats and Terraces known as C09.

An excellent outcome was achieved resulting in premiums being repositioned to single dwelling, C01 pricing effective 1/8/2019.

Other information provided in the Q&A document is available on the HBCF website, refer following link.

Icare Home Warranty Premium Rates

Main points

- Premiums are being adjusted to reflect the latest assessment of breakeven premium rates for all construction types.

- The premium changes scheduled for 1 August aim to make the fund sustainable (or break-even position), consistent with the previously announced objectives of the Government’s reforms.

- The changes vary depending on construction type. The below table sets out the changes, if any, for each type except for multi – dwellings which will be shown in a different table.

- Multi-Units will be increased based on becoming break-even and will incur considerable premium increases held back from the October 2018 price review, please make sure you contact our office before costing these projects effective immediately.

- In line with the premium increases, and the elimination of commission for the Broker, SHC will slightly adjust their fee for service to align with the Government increases and decreases that ensures that SHC continues to offer the highest quality service in managing your Home Warranty insurances whilst staying competitive in the market

Base Premium % numbers

(Note Government charges and fees to be added).

Base premium rates by construction type - Non-Multi dwelling construction

Multi-Unit premiums will increase in 4 tranches;

Base premium rates by construction type - Multi dwelling construction

* Note rates in this table are for Metro area, a 20% discount applied to rural area.

> Tranche I – 1 August 2019

> Tranche II – 1 January 2020

> Tranche III – 1 July 2020

> Tranche IV – 1 January 2021

Worldwide Insurance Market

Insurances premiums are increasing considerably across the globe, and Australia is no exception.

Australia is now subject to more frequent CAT events (cyclone, bush fire etc). All classes of insurances are increasing or will be increased over the coming years.

This has resulted in premiums increasing, particularly those with recent claims lodged.

This is an excellent time to have SHC review your insurances, ranging from Home and Contents through to all your Business Insurances.

Take advantage of SHC’s competitive pricing and Insurer panel.

To be sure, to be sure...

Larry’s barn burned down and his wife, Susan, called the insurance company. Susan told the insurance company, “We had that barn insured for fifty thousand and I want my money.”

The agent replied, “Whoah there, just a minute, Susan. Insurance doesn’t work quite like that. We will ascertain the value of what was insured and provide you with a new one of comparable worth.”

There was a long pause before Susan replied, “Then I’d like to cancel the policy on my husband.”